U.S. spot market truckload volumes fall 12% in May

PORTLAND, Ore. – Spot market truckload freight volumes failed to meet expectations in May, transportation information provider DAT Solutions said on Tuesday.

PORTLAND, Ore. – Spot market truckload freight volumes failed to meet expectations in May, transportation information provider DAT Solutions said on Tuesday.

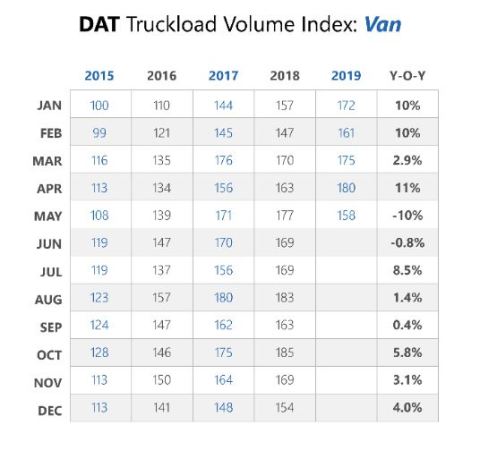

The number of full-truckload van loads moved on the spot market declined 12% in May compared to April, according to the DAT Truckload Volume Index.

Van load counts were down 10% compared to May 2018. Van trailers haul almost 70% of all truckload freight.

“Simply put, May was a disappointment in terms of load counts,” said DAT senior industry analyst Mark Montague.

“We’re accustomed to seeing higher volumes of retail goods, fresh produce, construction materials, and other seasonal spot truckload freight moving through supply chains at this time of year.”

DAT attributed the slump to uncertainty over trade agreements and falling imports from China. Record rainfalls, flooding and tornadoes also hampered freight movements in many parts of the country, it said.

At the same time, agriculture producers saw their supply chains disrupted by the weather, with many harvests ruined or delayed. As a result, refrigerated (“reefer”) volumes declined 8.3% month-over-month and fell 12% year-over-year, DAT said.

Flatbed load volume, which includes heavy machinery and construction material, dropped 9.3% month-over-month and 3.1% year-over-year.

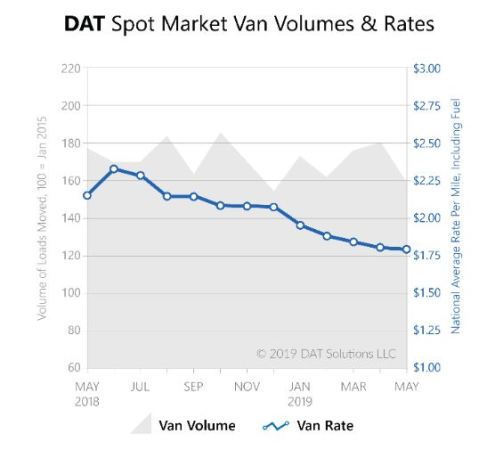

Spot truckload rates, meanwhile, continued to track well below last year’s record levels.

Compared to April, DAT said, the national average spot van rate was virtually unchanged at $1.80 per mile, including a fuel surcharge. That’s 35 cents below the average for May 2018, it said.

The average reefer rate was $2.15 per mile, 1 cent higher than April and 38 cents lower than May 2018. The flatbed rate averaged $2.27 per mile, down 5 cents compared to April and 45 cents lower year-over-year.

“After a lackluster May, June is shaping up to be a pivotal month for trucking,” Montague said. “We will know soon whether the volumes we expected in May were simply delayed. If so, the pent-up demand could boost seasonal volumes at the close of Q2.”

Founded in 1978, DAT Solutions is a wholly owned subsidiary of Roper Technologies (NYSE:ROP).

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.